Visa Card & MasterCard

Head of content

Due to the US economic sanctions against Iran, Iran’s banking system has been cut off from most of the world’s countries, and Iranians who intend to travel abroad have to use cash, which endangers their security. As you know, receiving Visa card and Mastercard is banned for Iranians. You can contact Qoqnous Trading for your foreign currency transfers and international payments with Visa and MasterCard.

In the following article, stay with Qoqnous Trading to review Visa and MasterCard, the uses and benefits of each.

What is MasterCard?

MasterCard is a payment network similar to Visa or American Express. The company is basically an American financial services company. MasterCard is a bank card like bank cards that are issued inside the country but with the possibility of international payment. MasterCard works with a wide variety of banks and credit card providers. But there are notable exceptions, such as Barclaycard, First Direct, HSBC and Nationwide, which use Visa. In Iran, it is not possible to use MasterCard, and you can leave all services such as money transfer and payment related to purchases from international sites to Qoqnous Trading.

Types of MasterCard

The types of MasterCard are: virtual MasterCard, physical MasterCard gift and rechargeable physical MasterCard. Each of these cards has its own advantages, which we will mention below.

Virtual MasterCard

Virtual MasterCard is suitable for people who intend to buy products online. Such as buying graphic designs from envato, shutterstock, etc., these cards can also be used to pay for embassy time. Virtual Mastercards have the ability to connect to PayPal account and you can verify your PayPal account with it.

Master card physical gift

The physical MasterCard has all the features of the virtual MasterCard plus some features that make it an advantage. The validity period of the gift physical MasterCard is one year, which is more valid than the virtual MasterCard and is suitable for travel. The charge limit of this type of card is 1000 dollars and they cannot be recharged.

Because these cards are physical, it can be used to buy from international sites such as shopping from Alibaba and Amazon, as well as paying from card readers in stores, but with this type of MasterCard, it is possible to receive cash from ATMs. There is no ATM. It can be said that these cards are a good alternative to cash.

Chargeable physical MasterCard

This type of MasterCard can be recharged and can be recharged up to $30,000 per year. This card can be charged up to $5,000 per day and have a maximum balance of $10,000. This type of card has a higher issuance cost and is suitable if you travel abroad a lot every year and want to be able to withdraw cash from ATMs.

How does MasterCard work?

Many banks are involved in payment operations. Mastercard provides the possibility of making transactions as a single fabric network. Therefore, the money is directly withdrawn from your account and transferred to the seller’s account.

Payment procedures using MasterCard:

- Your card account will be checked. It ensures that you have enough funds to make this purchase.

- It is notified to the seller’s account center that there is sufficient funds and the ability to make payments.

- Payment is made between the card provider and the seller.

What are the benefits of MasterCard?

MasterCard offers three levels of cards: Standard, World, and Gold, which we will examine below.

MasterCard Gold, in addition to having all the features of other MasterCards, gives you the ability to rent a car from reputable companies. With this card, you can easily pay all your travel expenses or make your online purchases. You can also use this MasterCard to pay offline, which is used during flights on international planes.

Other benefits of Mastercard Gold include the following:

- Low issuing and maintenance costs

- Ability to recharge in dollars or euros

- Ability to return money in case of not providing the service for which money has been paid.

- Ability to lock the card after payment

- Having a lifetime bank account to deposit to your account internationally

- Has SWIFT code for receiving and international payments

- Has an IBAN European account number

- Recharge the card without any restrictions

- Sending SMS for each transaction

- Can be used in all card readers connected to MasterCard

- Can be used in all ATMs connected to MasterCard

- Daily withdrawal limit from ATM up to 5000 dollars

- Ability to connect to electronic wallets including PayPal, Skrill and…

- It has an electronic chip to increase the security of the card

- The possibility of receiving a paper bill

- Ability to present to embassies and consulates

- High security, in case of illegal use of your card, such as hacking, illegal online shopping, all responsibilities are the responsibility of MasterCard.

- Using 24/7 services for MasterCard customers such as: reporting lost and stolen cards, emergency card replacement, emergency cash advances

What is a visa card?

Visa credit card is an integrated payment network, which processes payments using Visa systems. Using Visa card, you can make payments in all countries, send money to other countries or receive money from them, it is also possible to buy from internet sites and receive money. It is not possible to use Visa card in Iran. You can leave all services such as money transfer and payment related to purchases from international sites using Visacard to Qoqnous Trading.

The main competitors are Visa MasterCard or American Express. Visa is not a bank and does not issue cards, but instead provides the technology that credit card and debit card providers use for transactions.

And the way it works is that in order to make a purchase, the Visa payment system connects the buyer’s bank to the seller’s bank to complete the transaction.

How does Visa card work?

Visa credit cards work like any other credit card. You make a payment, it’s processed, and the amount is deducted from your credit card account balance.

Purchase steps using Visa card:

- Your balance will be checked.

- The seller’s bank is notified.

- A balance is deducted from your account and the purchase is made.

What types of cards use Visa services?

Visa is associated with different types of cards all over the world, such as:

Credit Cards

Visa credit cards, which are also called credit cards, are activated according to a person’s credit. To issue these types of cards, a person is validated by the banking system, and the person’s income history is taken into account, and after receiving it, the person can activate the account connected to the card without having cash. Buy the product on credit and pay for it in the future.

Visa credit cards have different types; Classic, Gold and Platinum Visa cards, which we will review briefly:

1- Classic Visa card

Classic visa card is the most popular card of the visa card family and you can use it to withdraw money from ATMs, buy from foreign websites and pay in person in stores. The low costs and many features of Visa Classic Card are the reasons for its popularity.

2- Visa Gold Card

Visa Gold Card includes all the services of Visa Classic Card, in addition to the fact that you can use it to make offline purchases. In offline shopping, you can make your purchases even when you don’t have access to the Internet, like shopping on an airplane. Most importantly, with the Visa Gold card, you can easily rent a car and the daily withdrawal limit is $5,000.

3-Visa platinum card

Visa Platinum Card is the highest level of Visa Card, which has all the features of the Classic and Gold card models. In addition, you can use its discounts and special advantages in international stores and airport lounges. You can also make unlimited withdrawals with this card.

Debit Cards

Buy a product and the money will be deducted directly from your bank account.

Prepaid cards

Funds are pre-loaded on the card and you can use it as an alternative to cash.

Types of visa cards

Visa cards are divided into physical and virtual types, each of which has its own advantages. We will examine them below:

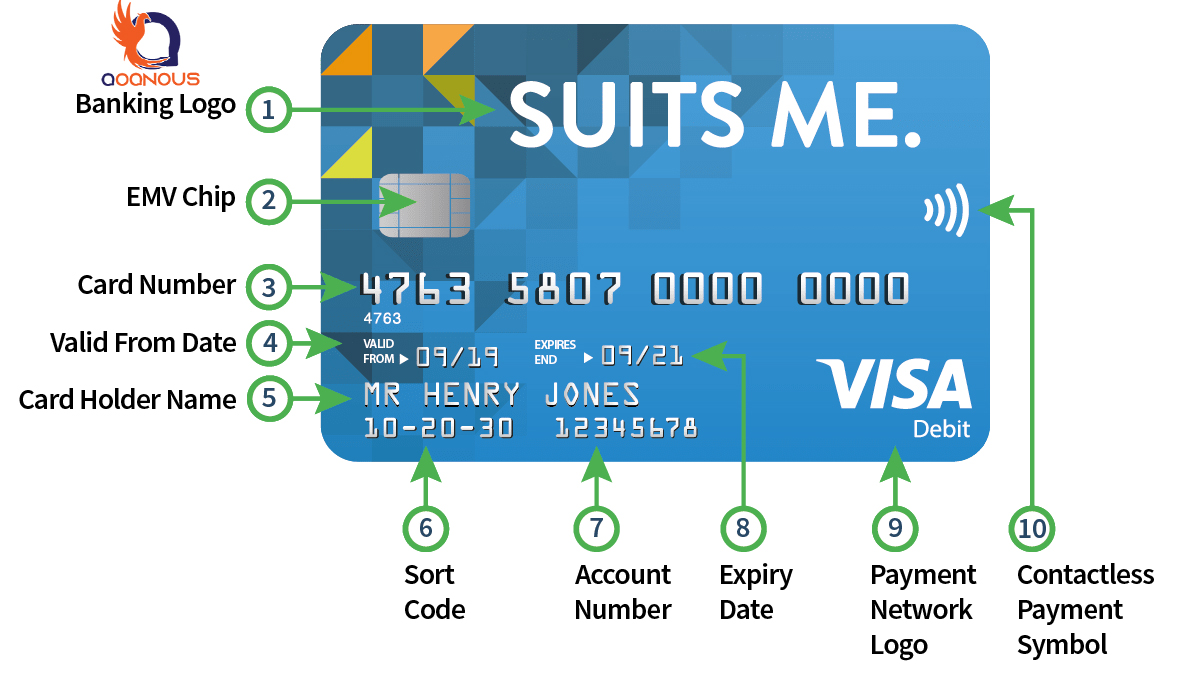

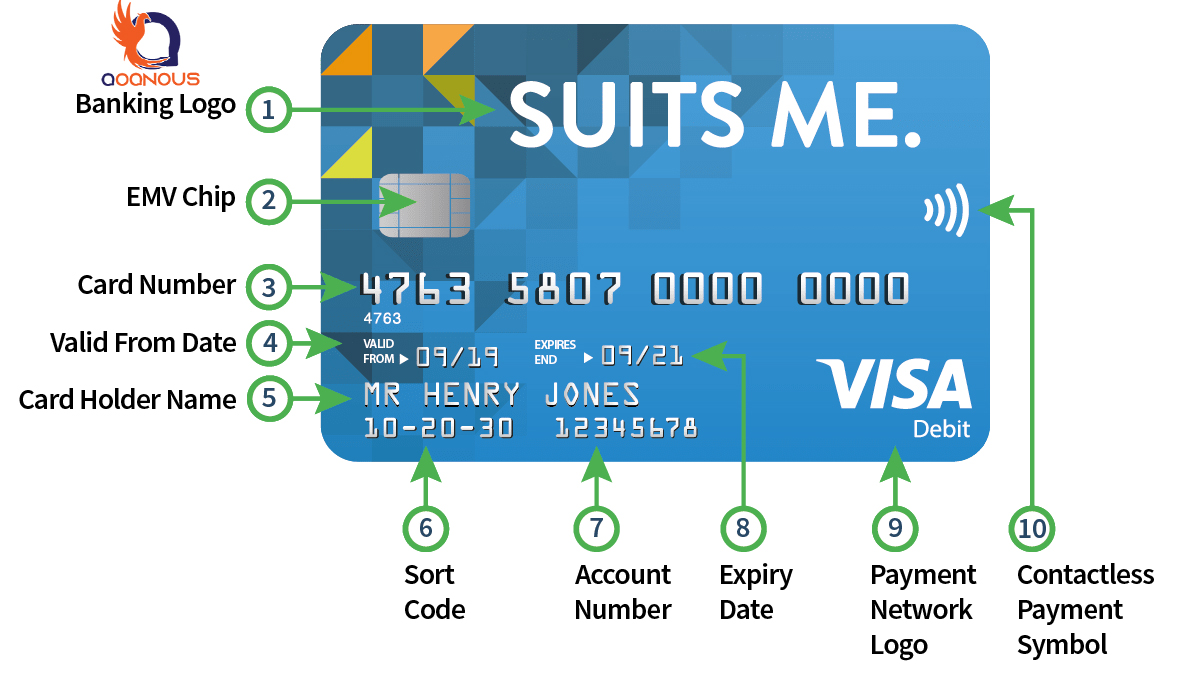

Visa virtual card

Visa virtual card is one of the valid international cards that you can use to make all your foreign currency payments online. The meaning of being virtual is that these cards are offered in a virtual form and the physical card is not provided to you, and only the details of the card, including the 16-digit card number, expiration date, and CVV2, are sent to you, and you use this information. You can make your payment. The card does not exist physically and you cannot use the card to receive money.

These types of cards are also known as gift cards and have many fans due to their cheapness, issuance in a short period of time and no need to pay an annual fee.

Using this card, you can buy from all online stores that support this payment method, sites such as: Netflix, Spotify, etc.

Visa physical card

Physical Visa cards are like many bank cards and are physically provided to you and linked to your main account. cvv2 card number and expiration date are listed on it. By using this card, you can buy in person using a card reader, send money around the world, and receive money from an ATM. You can also convert your account balance to other currencies.

Advantages of using Visa card

Using a Visa card has many advantages, the most important of which is the ability to use it in many countries such as France, England, China, etc. Other benefits of Visa card include the following:

- The ability to buy in person in stores using card readers

- Ability to receive cash from ATMs

- The ability to buy online from foreign sites such as Amazon and Alibaba

- Ability to transfer money to other international accounts

- Ability to connect to PayPal electronic wallet

- Paying the fees related to setting the time of the embassy of the United States, Canada, England, etc.

- Paying for international tests such as IELTS, TOEFL, Duolingo, GRE and…

What is the difference between MasterCard and Visa?

Master Card and VisaCard are similar in terms of services and usage and generally do not have many differences. Also, in providing services such as money transfer, money withdrawal and online purchases, both cards work in the same way.

These two cards have different benefits for their customers. Among the points offered, we can mention money back, loyalty points, etc. Therefore, when choosing a credit card, pay more attention to their benefits.

MasterCard and Visa abroad have different currency prices. These cards differ slightly in exchange rates.

Is MasterCard better or Visa card?

In the past, for most customers, there was usually little difference in choosing between MasterCard and Visa because they offer the same services. But now with Amazon’s decision not to support VISA card in 2022, the interest in using VISA is likely to decrease a lot.

last word

Qoqnous Trading is one of the best trading companies in Iran, which has been active in international trade for more than 10 years. Dear businessmen and businessmen, you can entrust us with online shopping from international sites using Visa and MasterCard. Contact our experts for a free consultation so that we can make all your payments in the shortest possible time.