International payment methods

Head of content

LC bills of exchange and letters of credit are actually international payment methods or ways of settling accounts, credits and commercial purchases. In many cases, the buyer and the seller are thousands of kilometers away from each other. Therefore, there must be paths and ways so that they can trust each other and complete their transactions. In addition, there should be pathways for accreditation. so that they can have long-term cooperation with each other.

In commercial and international trade, payment methods for goods are divided into two groups in terms of risk.

The first group: methods where the seller’s risk is high but the buyer’s risk is low.

The second group: methods where the buyer’s risk is high and the seller’s risk is low.

In the method where the seller’s risk is high, the seller sends the goods and then receives the payment, and in the methods where the buyer’s risk is high, the buyer pays for the goods before delivery.

In the rest of the article, be with Qoqnous Trading to take a closer look at the international payment methods and LC, which is a part of it.

What is simple Draft?

In this method, based on the agreement between the buyer and the seller, the seller transports the goods to the buyer’s destination and sends the shipping documents directly to him, then based on the shipping documents, he issues a simple Draft to the buyer. and sends it to the buyer’s bank through his bank. The buyer is also obliged to deposit it within the specified period of time based on the terms of the bill of exchange. Now the question arises, what is it for you?

A promissory note is a document that replaces money in a transaction and actually guarantees payment in the future. In other words, it is a document issued by the seller of the goods in favor of the buyer. The buyer must guarantee that he will pay his debt within a certain period of time.

Considering that the buyer pays for the goods after receiving the documents and clearance, there is no risk for the buyer, while the seller has to accept the risk of not accepting the bill.

Who are the parties involved in the Draft?

Bill of exchange issuer: is the party that issues the bill of exchange and orders the payment of a specific amount.

Receipt of bill of exchange: is the person or entity that receives the bill of exchange. He is ordered to pay the specified amount.

A bill of exchange usually contains the following information:

- Name and address of buyer and seller

- Bill amount

- Bill due date

- Signature and seal of the parties (seller and buyer)

What is a document collection Draft?

In this method, the goods are shipped to the buyer’s destination and the shipping documents are also sent to the buyer’s bank along with the invoice. If it is a collection bill, then the buyer’s bank is allowed to deliver the documents to the buyer only after receiving the money related to the transaction. Usually, buyers prefer to delay payment until the goods arrive. Therefore, according to the bill of collection, they set a certain period of time for payment, and the bank is required to hand over the shipping documents if the bill is accepted by the buyer or the payment is made.

What is a LC (letter of credit)?

In this method, the seller receives the cost of the goods after submitting the shipping documents to his bank. In this case, the risk of non-payment by the buyer is eliminated. This method is more beneficial to the seller, and the buyer has no control over the purchased goods, and in some cases, if the goods have not yet reached the buyer’s destination country, the seller receives the amount by presenting the documents. In this method, the seller must commit to the bank to send the goods after providing the documents within the specified time.

LC credit documents are divided into different types according to the functions and conditions mentioned in it.

Types of LC letters of credit

There are different types of letters of credit, which we will examine in order to familiarize yourself with the use of each and their differences. One of the most widely used for Iran is the back-to-back LC letter of credit, which is widely used due to sanctions.

Import or export letter of credit

The credit that the buyer opens for importing to his country is called import letter of credit, and this credit is export letter of credit for the seller of goods who is outside the buyer’s country.

Revocable LC

In this type of letter of credit, the buyer or the bank issuing the credit can make changes in the terms of the letter of credit without obtaining permission from the seller. This type of credit is not used much.

Irrevocable LC

In irrevocable letters of credit, any change in the terms of the credit by the buyer or the bank opening the credit must be done with the agreement and consent of the seller.

Confirmed LC

In some cases, due to the seller’s lack of trust in the buyer, lack of credibility of the buyer’s bank, or due to the unfavorable political and economic situation of the buyer’s country, the credit documents issued by the buyer’s bank must be approved by the seller’s bank.

Unconfirmed LC

In this type of credit, there is no need to confirm the letter of credit by another bank, and the buyer and the bank opening the letter of credit are trusted by the buyer.

Transferable LC

It is called a credit according to which the seller can transfer all or part of the opened credit to a third party. This type of credit is an advantage for the seller. In Iran, in order to open a transferable credit, it is necessary to obtain a license from the central bank.

Untransferable LC

In a non-transferable letter of credit, the seller does not have the right to transfer the entire opened credit or a part of it. Non-transferable letters of credit are usually used in international trade.

Term Letter of Credit (Usance LC)

According to the term letter of credit, the buyer is obliged to transfer the money to the seller within the specified period of time after receiving the goods. In fact, the seller gives the buyer a deadline to pay the price of the goods after receiving and selling them.

At Sight LC

In this type of letter of credit, after the seller delivers the shipping documents to the bank and the bank confirms it, the seller is obliged to pay the price of the goods.

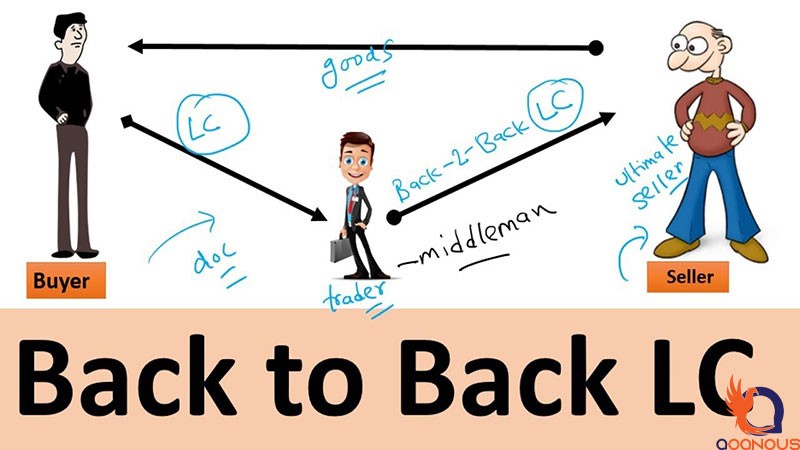

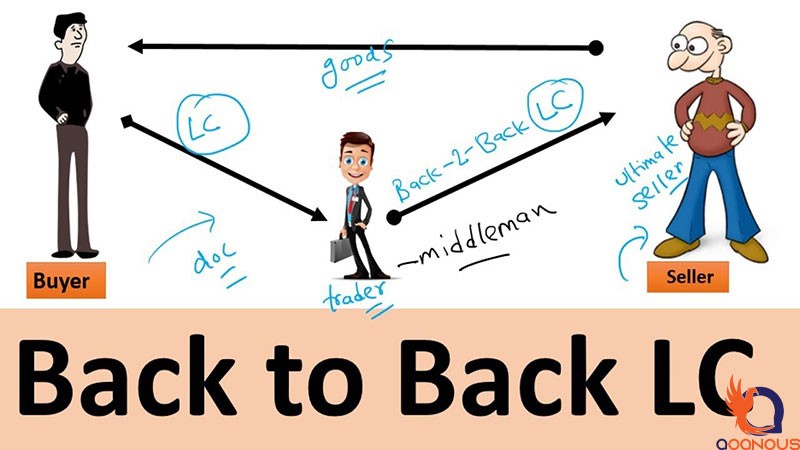

Back to Back LC

Back to Back LC is used when there is an intermediary between the buyer and the seller. In the first place, the buyer’s bank issues a letter of credit in favor of the intermediary, the intermediary uses the issued credit as a support and issues a letter of credit in favor of the seller. A back-to-back letter of credit actually consists of two separate credits, one issued by the buyer’s bank to the intermediary and the other by the intermediary’s bank to the seller. It should be noted that the first letter of credit must be irrevocable and confirmed so that another letter of credit can be opened using it. This method is used in Iran to circumvent sanctions, as a letter of credit is issued to an intermediary in a third country that is not sanctioned, and the third party uses it to open another letter of credit. He buys the goods, transports them to his country and transfers them to Iran from there.

Example for better understanding back to back letter of credit

For example, suppose that Company A is located in the United States of America and produces a product whose importation to Iran is prohibited. Company B, which is a trading company based in Dubai, has found out that an Iranian businessman intends to buy those products, but is unable to buy them due to Iran’s embargo. Therefore, Company B acts as an intermediary between the American company and the Iranian businessman.

An Iranian businessman opens a letter of credit through his bank for an intermediary, the intermediary uses it as a collateral and issues a letter of credit to a company based in America based on its support and credit from the bank of his country. Therefore, both the buyer is sure of receiving his goods and bypassing the sanctions, and the seller is sure of receiving his money.

The image below shows the role of the intermediary between the buyer and the seller.

Prepaid Letter of Credit or Red Clause LC

In this type of credit, the seller can receive an amount as an advance payment from the bank opening the credit before sending the goods. This happens if the seller needs initial capital to produce goods. The reason for the name of this credit was the use of red ink in the past to specify the advance payment in the letter of credit.

Revolving LC

It is a credit that after each use, the amount of documents increases up to the initial credit level, in fact, without the need to open a new credit, the existing credit is automatically repeated.

Advantages of using LC

- The seller’s assurance that after presenting the shipping documents, he will receive the credit amount from the broker or confirming bank according to the credit conditions.

- The possibility of controlling the date of shipment and final delivery of goods.

- Ensuring that the credit payment is made to the seller after the ownership of the goods is transferred to the seller.

- The possibility of receiving an advance payment by the seller to prepare the product

- The bank’s obligation to pay the price in transactions instead of the buyer

- Payment for goods after receipt of documents

Conditions and documents required to receive a LC

Among the necessary conditions to receive a letter of credit, the following can be mentioned:

- Having the citizenship of the Islamic Republic

- Having a business card

- Having a history of importing goods

- Not having a bad record

- Not having a returned check

- Business license for factories and production units

- Having a license for commercial companies

The difference between a Draft and LC

In the field of international trade, “bill of exchange” does not mean a commercial contract, but it is simply a document that is issued to guarantee the payment of money in commercial exchanges, so a bill of exchange is not a conditional obligation, while a letter of credit is a means of payment in international exchanges. and it is a conditional commitment in which it is possible to control the date of shipment and final delivery of the goods.

This letter of credit is a document that is mostly used in international or very large transactions. In this situation, the bank, as a trustee, guarantees the seller or the second party of the transaction that it will receive its money. On the other hand, the bank pays the money to the seller only when the buyer has received the goods. In these transactions, the bank only guarantees payment to the seller and receipt of goods by the buyer. But it does not provide a guarantee for the quality of the products.

Other international payment methods

Trade based on open account

In this method, based on the request of the buyer, the seller packages the desired goods and sends them to the destination customs office, and the shipping documents are sent directly to the buyer’s address to enable the customs clearance of the imported goods. After the goods arrive, the buyer must pay the price of the traded goods according to the agreed time period. This method has the lowest risk for the buyer and the highest risk for the seller.

Remittance method

This method is the least risky method for the seller, because he receives the payment for the goods from the buyer before sending them to their destination. On the other hand, the buyer assumes a lot of risk because he has paid for the transaction and is waiting for the goods to arrive. There are also risks such as not sending the goods on time, increasing the price from the seller, sending goods with lower quality and even not sending the goods completely.

Remittance method by obtaining a bank guarantee

In this method, the buyer requests a bank guarantee from the seller in exchange for the remittance of the cost of purchasing goods. The seller is also required to ask his bank to issue a guarantee in favor of the buyer, by notifying the buyer of the guarantee, the buyer is obliged to remit the entire amount of the transaction to the seller. Considering that this method is a guarantee for sending goods, there are still risks such as delay in sending or low quality compared to the agreement.

last word

Qoqnous Trading Company has been active in the field of international trade for more than 10 years and is one of the best known trading companies in the country. By employing the best and most expert people in this field, Qaqnoos Trading provides all bill of exchange services, opening various letters of credit such as back-to-back LC letters of credit for Iranian businessmen. Just contact our experts and specialists.